With the election that just passed, there was a lot of attention drawn to the potential scrapping of negative gearing benefits, which left a lot of people wondering, ‘What is negative gearing?’

Negative gearing is a term mostly used by investors, and the reason it is talked about so much in the property world, is because the Governments gearing policies have a great impact on how attractive the property market is to investors.

There are three types of gearing; Negative, positive and neutral.

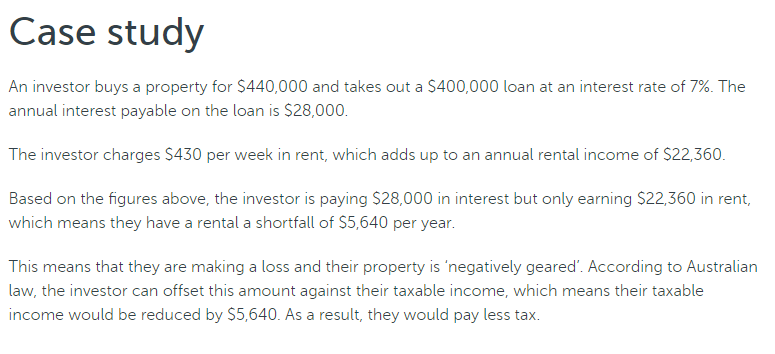

Negative gearing is borrowing money to invest in an asset (most commonly a property) and the income from your investment (for example, rent) is less than your expenses meaning that you are making a loss. This isn’t a bad thing for investors because Australian law allows them to deduct any losses they make on their investment from their taxable income, which makes the property market a lot easier for investors and often leads to an increase in rental housing supply.

Investors typically buy investment properties not for the rent but in the hope that the property will eventually increase in price to a point where a healthy profit can be made from the sale of the property which is called capital growth. Negative gearing works best if the capital growth of an investment is greater than the loss that they make from the rental shortfall.

Positive gearing is the opposite, so if the income you make on your investment is more than your expenses, you are positive gearing. In this case you aren’t able to make tax deductions from your taxable income, and the income from your property will be subject to tax at your marginal rate.

Neutral gearing is the same concept except your income is equal to your expenses. As you are breaking even, you cannot deduct any losses from your taxable income.

Example below from a realestate.com.au article by Peter Koulizos